SYNO GROUP CAPITAL Private Limited is a capital company officially registered in Singapore in 2024. In its early years, before formal establishment, the company operated as an accounting and human resources firm.

With rapid business expansion, Syno Group Capital is currently collaborating with a major stock market company in Kuala Lumpur, Malaysia. The company raises funds by using listed company stocks as collateral for loans, entering the stock lending market, also known as equity financing.

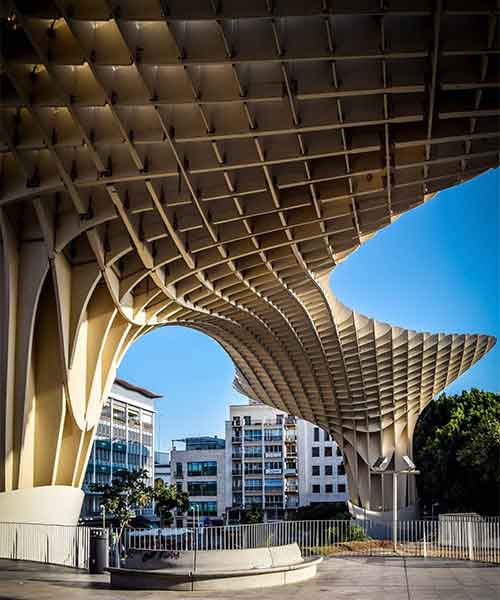

Syno Group Capital has community offices in nearly all Southeast Asian regions, providing client services through these offices.

In 2024, Syno Group Capital plans to advance with its unique strategies, engaging with investment clients to share savings models in the financial market and generate profits. Additionally, it aims to facilitate capital flow into the stock trading market.Investing in the Stock Market

Equity financing and listing of company shares

Professional observation and balancing of risk-return for equity financial stocks

Collaborating with professional teams on market projects, auditing reports, and planning to ensure stability

Sharing profits with loyal investment clients on a monthly or quarterly basis

Syno Group upholds the corporate philosophy of "Professionalism, Innovation, Integrity," focusing on client interests at its core. Through excellent asset management and innovative investment strategies, we are dedicated to becoming a leading global investment management institution. Our goal is to provide investors with a stable, sustainable, and high-return investment experience.

Actively participate in high-quality IPO projects to secure exceptional returns.

Select stocks of potential companies, hold them long-term, and achieve steady appreciation.

Engage in corporate mergers and acquisition projects to discover and capitalize on market opportunities.

Utilize various hedging tools to effectively manage and control portfolio risk.

Meeting our client goals is the true measure of our success. We seek to combine our expertise within a risk focused environment as we work towards delivering intended outcomes for clients.

Clients entrusting their investment decisions to us is a responsibility we do not take lightly. We understand that future plans and security depend on whether we deliver. Our relationships are not transactional – rather, they are partnerships built on trust. We are not simply a product manufacturer, but a partner seeking to evolve what we offer and provide expert insight to help inform client decision-making throughout the investment journey.

Our investment teams apply their expertise to analyse risk versus return potential, engage extensively with companies and invest with conviction. The teams are structured in ways that we believe are best suited to their asset classes and operate with an appropriate level of flexibility within a risk-managed environment. This means our teams are genuinely active, utilizing insight and originality in seeking to take advantage of market inefficiencies.